Investing in mutual funds has now become easier than ever, and all this has been possible with the help of digital investment platforms. In today’s article, we will tell you about the best mutual fund investment apps 2025 available in India for 2025. Let us tell you that choosing the right app not only simplifies your investment experience but also helps you get better returns.

In this article, we will discuss in detail the features, benefits, and usage of these apps. If you want to make smart and safe investments in 2025, then this article will prove to be very useful for you. Also, we will tell you which app is best for your needs. So let us first understand what is a mutual fund!

What is a Mutual Fund?

A mutual fund is an investment scheme where investors’ money is pooled and invested by a professional fund manager in various options like stock market, bonds, money market instruments, and gold.

For example: If you invest ₹5000 in a mutual fund and the fund gives a return of 12% per annum, your investment can grow to more than ₹1 lakh in 10 years.

Now let us know about the 5 best mutual fund investment apps in India that can make your investment easy and profitable.

Best Mutual Fund Investment Apps in India for 2025:

In this article, we have included such apps which are SEBI registered mutual fund apps, and also charge zero fees on investments. Apart from this, we have also included such apps in this article which are available with unique and simple features, interface, and design. So let us now know about these apps.

1. ZFunds

ZFunds is a mutual fund. Its simple and user-friendly app interface is liked by everyone. It can be a great option for beginners and experienced investors for mutual fund and SIP investments. If we talk about its brokerage charges, then the brokerage fee is 0.03 percent or Rs 0.03 of the total amount of your investment. So let us now know about the main features of ZFunds

KEY FEATURES:

- SIP starts from ₹100 per day.

- Expert financial advice and 24/7 customer support.

- Mutual Fund Portfolio Management.

Example: If you invest ₹3000 per month through SIP using ZFunds, it can give huge returns in 10 years.

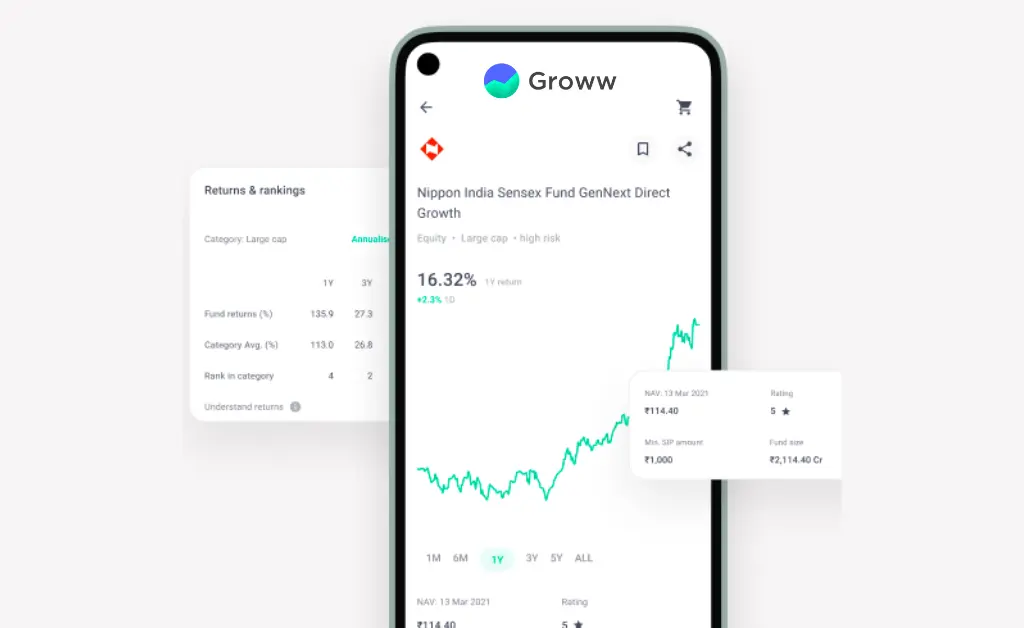

2. Grow

Groww App is one of the most popular apps for investing in mutual funds, the stock market, and SIP. The design and interface of Groww App is user-friendly, due to which most people use this app. Apart from this, Groww App charges a brokerage fee of ₹ 20 or 0.1% per order, whichever is lower, for stock trading. Also, if the brokerage per trade is less than ₹ 2, then the minimum brokerage of ₹ 2 will be applicable. So let us now know about the main features of the Groww App.

KEY FEATURES:

- Simple interface and low cost.

- Paperless process and portfolio tracking.

- Facility to invest in stocks and mutual funds simultaneously.

Example: If you invest on Groww with a monthly SIP of ₹5000 you can create a fund of over ₹50 lakh in 20 years.

3. ETMoney

ETMoney is a trusted app for personal financial management and investment. It is very popular among those who invest in the Indian stock market and mutual funds. Its interface and design are liked by everyone. Apart from this, its brokerage rate is also very low. If you invest in mutual fund investment or redemption, ETMoney does not charge brokerage. This is because you can invest in mutual funds directly through ET Money, which means that you are investing directly with the fund house and there is no broker involved because of this most people use ETMoney to invest in mutual funds. So let us now know about the main features of ETMoney.

KEY FEATURES:

- Tax-saving investment options.

- Expense tracking and SIP calculator.

- Facility of investing in ELSS (Equity-Linked Savings Scheme).

Example: If you invest ₹1.5 lakh in ELSS funds through ETMoney, you can save tax and get high returns.

4. Zerodha

Zerodha is quite popular for mutual fund and stock market investments in India. Due to its simple design and interface, new and experienced investors use Zerodha for their investments. If we talk about its brokerage charges, Zerodha does not charge any commission for investing in mutual funds. Zerodha launched the Coin platform for direct mutual fund investment in April 2017. By investing in direct mutual fund schemes, investors can save a lot on the commission paid as compared to buying regular mutual funds. If we talk about my personal view, I started my investment journey with Zerodha. My experience with Zerodha has been very good, along with this I also liked their support system.

KEY FEATURES:

- Zero commission on all mutual funds.

- Premium analytics tools and easy investing.

- Integration of stock market and mutual funds.

Example: If you invest a lump sum of ₹10,000 with Zerodha, then higher returns can be earned with zero commission through Zerodha Coin.

5. Paytm Money

If you are also using Paytm, then it will be even easier for you to use Paytm Money. Because the interface and design of Paytm Money and Paytm App are quite similar, most Paytm users use it to invest in mutual funds, stocks, and gold. So let us now know that if you invest in mutual funds with the help of Paytm Money, then no commission is charged for investing in mutual funds, due to which Paytm Money App can also be a good option for investing in mutual funds. Finally, let us know about the main features of Paytm Money.

KEY FEATURES:

- Secure and paperless KYC.

- Custom Portfolio Tracking.

- Mutual Fund, SIP, and Digital Gold investment facility.

Example: If you invest ₹2000 monthly through SIP for 15 years with the help of Paytm Money App then a huge corpus can be created with Paytm Money.

6. Angel One

Angel One is one of the trusted and popular mutual fund investment apps, let us tell you that Angel One is an all-in-one platform that allows you to invest in stocks, IPOs, and mutual funds. If we talk about its popularity, then more than 2 crore investors in the country use it, the main reason for this is its interface which is quite simple and unique, due to which new and experienced investors can also use and invest easily in it. Now let’s talk about how much fee you will have to pay if you invest in mutual funds with the help of Angel One. So let us tell you that Angel One does not charge any fee/commission. So let us now know about the main features of Angel One.

KEY FEATURES:

- Invest in 5000+ Mutual Funds.

- Futures and Options Trading.

- Investment management through smart orders.

Example: If you use Angel One with ₹4000 monthly SIP through the Angel One app you can get better returns in 10 years.

Conclusion:

Finally, choosing the right mutual fund app for investing in 2025 is crucial to meet your investment goals. Through apps like ZFunds, Groww, ETMoney, Zerodha, Paytm Money, and Angel One, you can make safe investments and get good returns.

By understanding the features of these apps and choosing according to your needs, you can make your investment journey more profitable. So don’t delay, download your favorite app today and secure your financial future! If you have any kind of questions about these apps, you can ask us through comments.

FAQs:

What is the best mutual fund investment app in India for beginners?

For beginners, apps like ZFunds and ETMoney are ideal due to their user-friendly interface, expert financial advice, and paperless processes.

Are these mutual fund apps free to use?

Yes, most of the apps mentioned, like Zerodha, ETMoney, and Paytm Money, allow direct mutual fund investments without any commission or brokerage fees.

Can I invest in SIP through these apps?

Absolutely! All these apps, such as Groww and Angel One, offer seamless SIP investment options starting from as low as ₹100.

Which app is the best for tax-saving investments?

Apps like ETMoney and ZFunds offer tax-saving options, such as investing in ELSS (Equity Linked Savings Scheme) funds, which help save taxes under Section 80C.

Are mutual fund investments safe through these apps?

Yes, these apps are SEBI-registered and follow strict guidelines, ensuring safe and secure transactions for investors.

What is the minimum investment amount for SIPs in these apps?

The minimum SIP amount varies by app but typically starts at ₹100 (e.g., ZFunds) or ₹500 (e.g., Paytm Money), making it accessible to everyone.

Can I invest in other financial instruments apart from mutual funds through these apps?

Yes, apps like Zerodha, Angel One, and Groww also allow you to invest in stocks, IPOs, F&O trading, and even digital gold.

Do these apps charge a withdrawal fee?

No, most of these apps, such as Zerodha Coin and ETMoney, do not charge any withdrawal fees for mutual fund redemptions.

Can I use more than one mutual fund app?

Yes, you can use multiple apps simultaneously for investing, but it’s advisable to consolidate your investments to track them efficiently.